Tax-deductible expenses for real estate agents is such an important area for their sales business. Knowing how and what to deduct can help reduce taxable income and ultimately lower the amount of income tax owed to the government. Everyone wants that, right?! Real estate agents, like other self-employed individuals or small business owners, can really benefit from understanding and using these tax deductions.

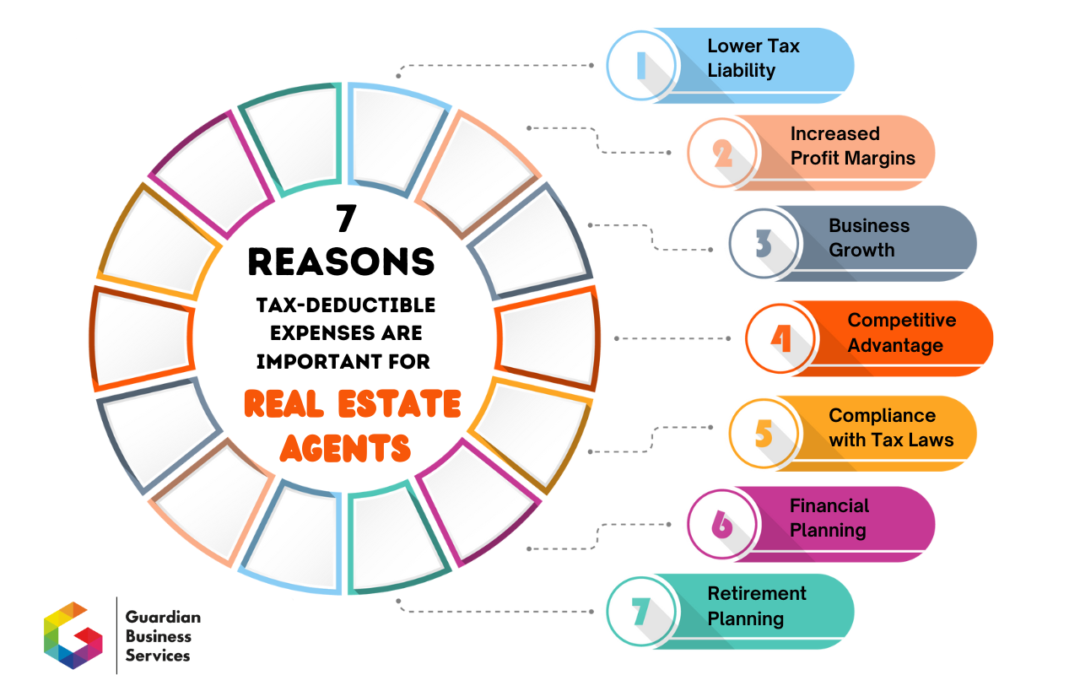

Here’s why tax-deductible expenses are important for real estate agents:

- Lower Tax Liability – Real estate agents can deduct eligible business expenses from their taxable income, which reduces the overall amount of income that is subject to taxation. This results in a lower tax liability, meaning they pay less in income tax, leaving more money in their pockets.

- Increased Profit Margins – By reducing taxable income through deductions, real estate agents can effectively increase their profit margins. This extra money can be reinvested in the business, saved for future expenses, or used for personal financial goals.

- Business Growth – Lowering taxes means real estate agents have more funds available for business development, marketing, training, or expanding their real estate portfolio. This can help them grow their business and increase their earning potential.

- Competitive Advantage – Real estate agents who manage their finances well and maximize their deductions may be more competitive in the market. They can offer competitive commission rates, invest in professional development, or provide better customer service, all of which can attract more clients.

- Compliance with Tax Laws – Properly documenting and deducting eligible expenses ensures compliance with tax laws. Failing to do so may result in audits, penalties, or legal issues, which can be financially damaging and time-consuming.

- Financial Planning – Understanding tax-deductible expenses allows real estate agents to engage in effective financial planning. They can allocate resources strategically, make informed decisions about business expenses, and create a budget that optimizes their financial position.

- Retirement Planning – Real estate agents can also use deductions to contribute to retirement plans such as a Simplified Employee Pension (SEP) IRA or a Solo 401(k). These contributions are tax-deductible and can help them secure their financial future.

Once you realize the importance of keeping track of your expenses, you may wonder “So, which expenses are tax-deductible and why?” Well, we have you covered. Read on to find out!

Top 5 Tax-Deductible Expenses for Real Estate Agents

These expenses are generally considered tax-deductible expenses for real estate agents because they are essential for promoting and conducting their business. It’s important to keep accurate records of expenses, including receipts and invoices, to support the deductions. The Why: Here are some reasons why the Internal Revenue Service (IRS) puts marketing and advertising in this category:

- Ordinary and Necessary: The IRS allows deductions for business expenses that are both “ordinary” (common and accepted in the industry) and “necessary” (essential for conducting business). For real estate agents, marketing and advertising are essential components of attracting clients and generating income.

- Promoting Business Growth: Marketing and advertising expenses are directly related to expanding a real estate agent’s client base and increasing sales. Deducting these costs encourages businesses to invest in growth and competition.

- Direct Business Expense: Expenses like printing flyers, running online ads, creating a website, or hiring a marketing consultant are directly tied to promoting properties and securing clients. These are clear business expenses that can be deducted.

- Cost of Doing Business: Just like other businesses, real estate agents incur costs to maintain their presence in the market. Deducting marketing and advertising expenses helps offset the overall cost of doing business.

Vehicle expenses are tax-deductible for real estate agents because they often use their vehicles as an essential part of their business operations. It’s important to keep detailed records of vehicle usage and expenses to substantiate the deductions. This includes maintaining a mileage log, tracking fuel costs, and documenting parking and toll expenses. The Why:

- Business Use: If they use their vehicle for business purposes, such as showing properties to clients, attending meetings, or traveling to and from properties, those miles and associated expenses can be considered business-related.

- Ordinary and Necessary: Vehicles are frequently used in this field to carry out their job duties, making vehicle expenses ordinary and necessary.

- Mileage Deduction: Vehicle expenses can be deducted using either the standard mileage rate or actual expenses. The standard mileage rate is a predetermined amount per mile driven for business purposes, which simplifies the deduction process.

- Depreciation: If they own the vehicle they use for business, they can also depreciate the cost of the vehicle over time, which can provide additional tax benefits.

- Parking and Tolls: Expenses related to parking fees and tolls incurred while conducting business can also be deducted.

Home office expenses can be tax-deductible expenses for real estate agents who use a portion of their home exclusively and regularly for conducting business. Common home office expenses that fit into this category may include a portion of your rent or mortgage interest, property taxes, utilities, and home maintenance costs directly related to the home office. It’s important to meet the IRS requirements for claiming the home office deduction, maintain accurate records of your home office expenses, and ensure that your home office space is used exclusively for business purposes. Consulting with a tax professional or accountant who specializes in real estate taxation can help you navigate the specific rules and ensure that you’re maximizing your eligible deductions while staying in compliance with tax regulations. The Why:

- Business Use of Home: The IRS allows a deduction for the business use of a home if it meets specific criteria. To qualify, the portion of your home used for business must be exclusively and regularly used for business activities, such as administrative tasks, client meetings, or paperwork related to your real estate business.

- Ordinary and Necessary: Similar to other deductible business expenses, the IRS recognizes that many real estate agents need a dedicated workspace at home to efficiently manage their business affairs.

- Simplified Method: The IRS offers a simplified method for calculating the home office deduction, which simplifies the process by allowing you to deduct a set amount per square foot of the home office space, up to a maximum square footage limit.

- Reduction in Taxable Income: Deducting home office expenses can reduce your taxable income, potentially lowering your overall tax liability and providing financial relief.

These are tax-deductible expenses for real estate agents because they are considered necessary expenses for conducting and improving their business. Again, it’s important to keep all receipts! Here’s why these are tax-deductible:

- Ordinary and Necessary: Real estate agents often rely on professional organizations and memberships to stay current, network, and access resources, making these fees necessary for their profession.

- Education and Training: Many professional memberships include access to educational resources, workshops, and training sessions that help them stay informed about industry developments and improve their skills. These opportunities enhance their ability to serve clients effectively.

- Networking and Referrals: They often benefit from networking with other professionals in their industry, which can lead to referrals and collaborations. Professional memberships provide access to these valuable networks.

- Professional Development: Real estate agents are required to stay licensed and compliant with changing real estate laws and regulations. Membership in professional organizations often includes resources for continuing education and staying up-to-date with legal and ethical standards.

- Business Growth: Access to industry-specific tools, market data, and technology through professional organizations can help them grow their businesses and better serve their clients.

For real estate agents, office expenses and equipment are a vital (ordinary AND necessary) part of their business, if you know anything about the paperwork involved! Here’s why:

- Business Operations: Office supplies such as paper, pens, computer software, and hardware are critical for conducting day-to-day business activities, including preparing contracts, marketing materials, and maintaining client records.

- Professionalism: A well-equipped office helps project a professional image to clients and partners. Investing in office equipment and supplies is often necessary to maintain a competitive edge in the real estate industry.

- Efficiency and Productivity: Up-to-date office equipment and software can enhance productivity and efficiency. Time-saving tools and technology can enable real estate agents to serve their clients more effectively.

- Marketing and Promotion: Expenses related to marketing materials, such as brochures, flyers, and promotional items, fall under office expenses. These materials are crucial for marketing properties and attracting clients.

- Home Office Deduction: Real estate agents who maintain a dedicated home office space can also deduct a portion of their home-related expenses, such as rent, mortgage interest, utilities, and maintenance, as part of their office expenses.

Along with keeping all receipts, logs, documents, and invoices, remember that tax laws and regulations can change. It’s advisable to consult with a tax professional or accountant to ensure compliance with current tax rules and maximize deductible expenses.

If you need some help getting or staying organized with your business’s finances, reach out to us! We can help you get on track and stay that way, reducing your frustration at tax time, all while helping you to save money and grow your business!